How a high cash rate impacts property prices - (New Zealand & Canada edition)

What’s on our mind: Canada cash rate (2.5%) property prices down ~19%, New Zealand cash rate (2.5%) property prices down ~14%. Sydney and Melbourne to suffer a similar fate?

What happened this week: Australian Consumer price index +6.1%, US Federal Reserve raised the cash rate by 0.75%, US GDP - 0.9%.

What are we watching next week: RBA cash rate decision, Australian building approvals, UK rate decision, US unemployment data.

Prelude:

What’s on our mind:

This week we took a step back from the Australian property markets and looked abroad.

After all, Australia isn't the country with an overvalued housing sector, experiencing high inflation and increasing interest rates.

The reality is that it is a global problem.

First, we need to establish which of these countries fits the bill.

Going into 2022, a list of the top 10 most unaffordable cities was as follows:

Taking out the US and China (Worlds biggest and 2nd biggest economies), we are left with Australia, Canada and New Zealand proudly represented by:

Australia - Sydney (2nd most expensive), Melbourne (5th most expensive).

Canada - Vancouver (3rd most expensive), Toronto (10th most expensive).

New Zealand - Auckland (8th most expensive).

These countries have no business even ranking in these lists, with Australia being ranked the 13th largest economy in the world, Canada 9th and New Zealand 48th….

In fact, a startling fact...

If you combined all three of their economies, they would still be 6x smaller than the USA and 4.5x smaller than China.

When we say, they have no business ranking on this list... We mean it.

So what do all three of these economies have in common?

Interest rates in all three of these countries are increasing monthly.

One key difference, though, is that both New Zealand and Canada started increasing rates a lot earlier than Australia and have kept increasing at a much faster rate.

For example:

Reserve Bank of New Zealand has a cash rate of 2.5%.

Reserve Bank of Canada has a cash rate of 2.5%.

Both sit comfortably above the Aussie cash rate at 1.35%.

The speed at which both countries responded is evident in the last rake hikes they made.

Whereas the RBA raised rates by 0.5% at its last meeting, the RBNZ and Canada increased theirs by 1%.

Now the final piece of the puzzle…

What impact has rising interest rates had on property prices in both Canada and New Zealand?

We think that whatever is happening in both of these countries will almost certainly follow in Australia as we catch up to and maybe even surpass their interest rates.

A summary of our findings before we do a deeper dive:

Canada - 2.5% cash rate - Vancouver down ~18.5%, Toronto down ~14%,

New Zealand - 2.5% cash rate - Auckland down ~14%, Wellington down ~12%.

How about here in Australia:

Australia - 1.35% cash rate - Sydney down 5.3%, Melbourne down 3.4%.

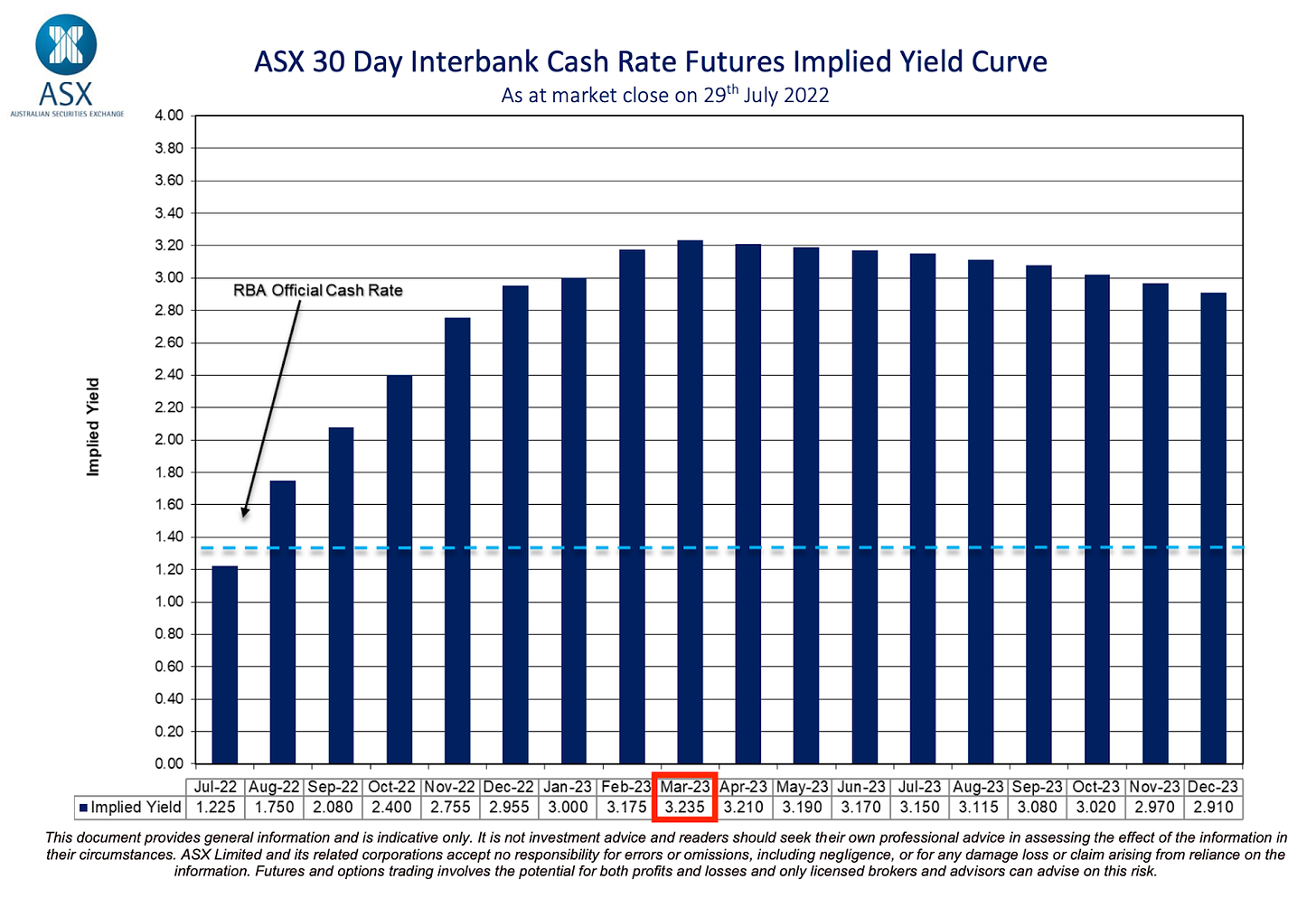

With the RBA signalling, aggressive rate rises, and the market is now expecting the cash rate to peak at ~3.2% in March 2023.

We may be a few months behind the Canadians and the Kiwis, but our fate will ultimately be the same.

What’s happened in NZ:

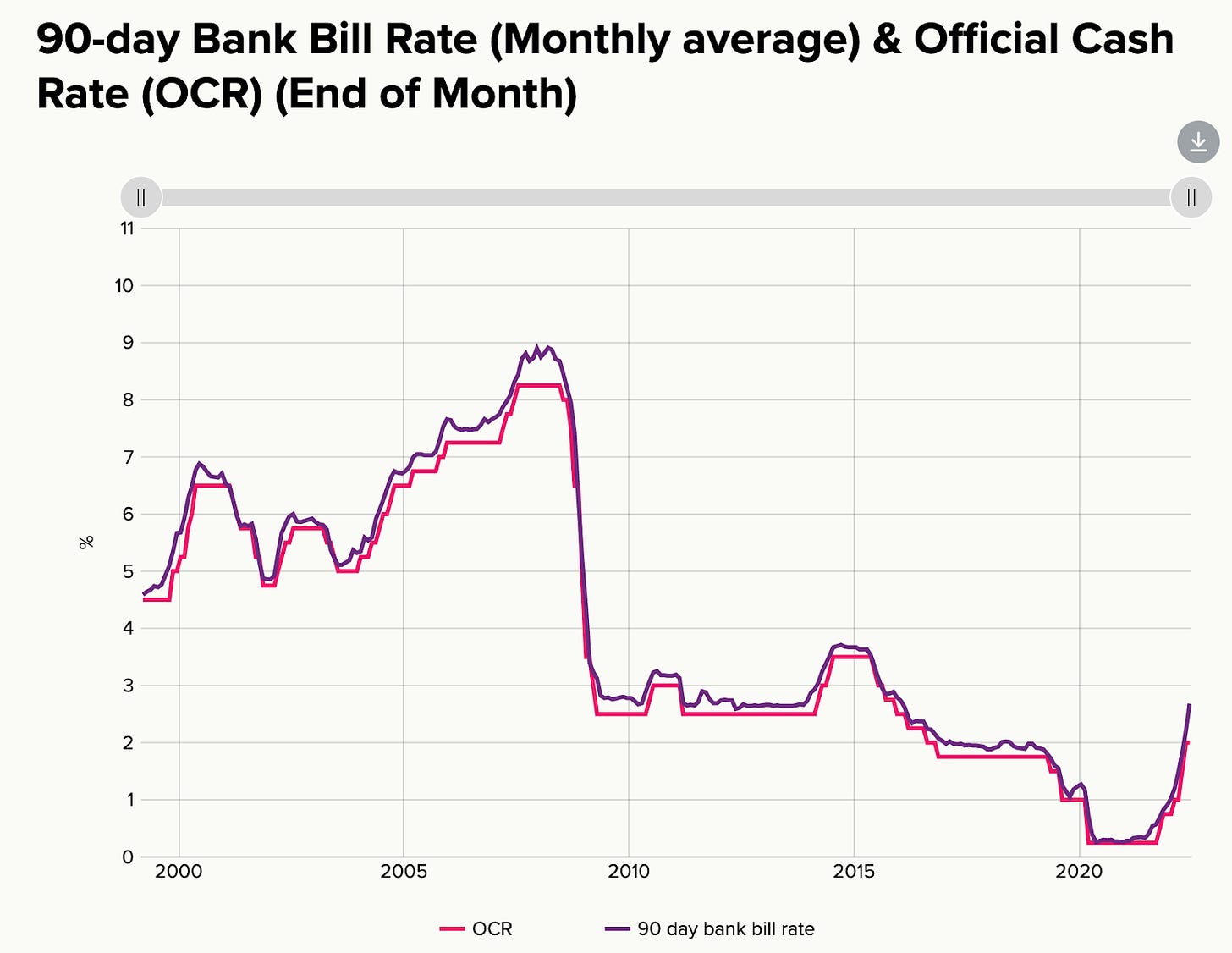

On the 16th of March 2020, the Reserve Bank of New Zealand reacted to the pandemic by cutting interest rates from 1% down to 0.25%.

A few weeks later, the central bank started pumping more money into the system by purchasing government bonds to finance fiscal stimulus.

In December 2020, the central bank even introduced a “funding for lending programme”, a policy akin to the term funding facility we saw in Australia.

The result of all this stimulus?

House prices rose by 41% in 2021.

Then everything changed, and the Reserve Bank of New Zealand first started lifting its cash rate in October 2021 by 0.25%, taking the cash rate to 0.5%.

Over the following nine months, the bank increased the official cash rate on five separate occasions.

The latest rate hike came on the 13th of July and saw the Reserve Bank Of New Zealand hike rates by 0.5%.

This took the official cash rate in New Zealand to 2.5% - a level not seen since March 2016.

So what impact has this had on property prices?

So far, prices in New Zealand’s two biggest cities have behaved as we expected with:

Auckland prices are down ~14% from the peak.

Wellington prices are down ~12% from the peak.

Given that the average property price for Auckland in 2021 was $1.3M, the average buyer is now holding property worth $182k less than what they paid.

Can things get worse?

We will let the following quote from the Reserve Bank Of New Zealand answer this question for us - “Indeed, in the May Monetary Policy Statement, we forecast a 15% decline in house prices from their peak, which would bring them roughly back to sustainable levels.”

Even the central bank is bearish.

With the Kiwi inflation rate running hot at almost 20-30 year highs, the central bank seems to be more focused on bringing down inflation via rate hikes than they care about property prices.

This will mean more rate hikes over the coming months.

It remains to be seen what happens, but we expect prices to continue falling as long as the central bank is hell-bent on increasing interest rates further.

The part that isn't discussed is the impact falling property prices have on banks…

With house prices falling, banks will become much tighter when making new lending decisions. In fact, if prices get low enough, the banks will have bigger things to worry about than writing new loans.

On balance, we expect price falls to get a lot worse as interest rates continue increasing.

We will be monitoring…

What’s happened in Canada:

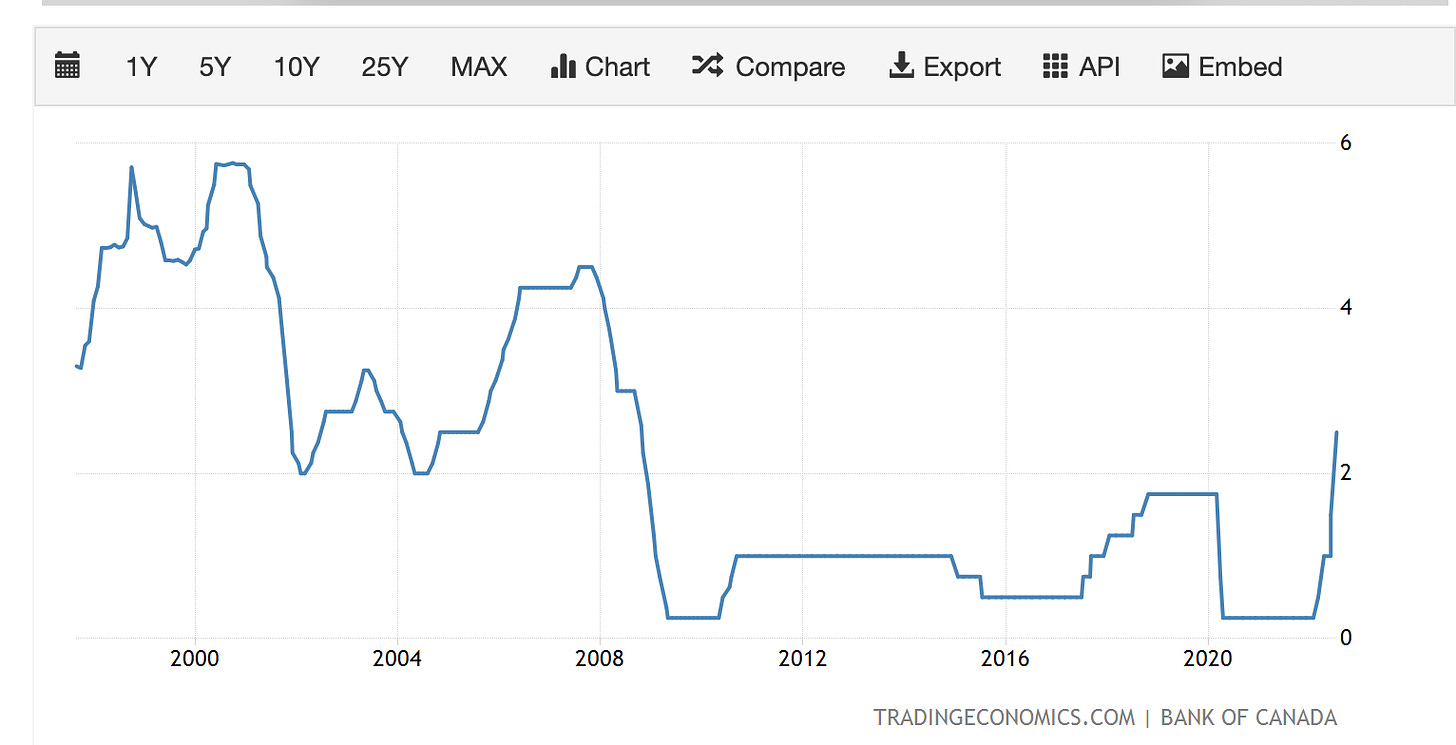

On the 27th of March 2020, the Central Bank of Canada decreased its cash rate from 0.75% to 0.25%.

Following the rest of the world, the Canadians flooded their economy with cheap money through asset purchases, debt purchases and a serious amount of encouragement to the commercial banks to make credit easily accessible to the Canadian public.

The last of those was so paramount the Bank of Canada actually wrote about it in a press release. Here are the quotes of interest:

“At first, our goal was to help Canadians bridge this difficult period by making credit affordable and available”.

“The central bank must therefore intervene to prevent a sudden contraction of credit when credit is most needed.”

Basically, the Bank of Canada’s mandate became to make credit accessible.

This adoption of loose monetary policy went on through all of 2020, 2021 and even into the start of 2022.

The result of all this stimulus?

House prices rose by 26% in 2021.

Identical to both Australia and New Zealand, the Canadian central bank had a change of heart a few months ago, with its first rate hike in two years coming in March.

Since then, the Bank of Canada has increased the official cash rate on four separate occasions.

The latest rate hike came on the 14th of July and saw the Bank of Canada increase rates by a full 1%.

This took the official cash rate in Canada to 2.5% - a level not seen since before the Global Financial Crisis in 2008.

Almost 15 years ago…

So what impact has this had on property prices?

So far, prices in Canada’s two biggest cities have behaved as we expected with:

Vancouver prices are down 18.5% from the peak.

Toronto prices are down 14% from the peak.

What’s worse for the Canadians is that the economy is that these levels of rates haven't been seen in Canada for a long time...

Back in 2008, when rates were >2%, the average house price in Vancouver was ~CAD$765k.

Now it is almost CAD$1.25M.

Our house view isn't to see prices go back to 2008 levels, but if they did, that would be an almost 40% fall from current levels.

This naturally brings us to the question of:

Can things get worse?

This time we will let Canada’s biggest bank do the talking, with economist Robert Hogue from Royal Bank of Canada saying:

“Benchmark home prices could fall more than 12% through early next year from the market’s peak, a bigger decline than any of the four national downturns of the past 40 years”.

Hogue also said, “Sales are also expected to slump 23% this year and 15% next year”, and “That total decline of 42% since early 2021 would outrank the 38% drop in 2008 and 2009”.

Canada is basically in a position where one of its biggest banks is calling for the mother of all downturns.

With the Bank of Canada flagging further rate hikes, we think the situation will only worsen.

We will be monitoring...

What we think will happen in Aus:

We are a few moves behind the eight-ball at the moment.

The market expects the cash rate to peak at 3.25% in March 2023.

This would mean we see a further 1.9% increase in the cash rate over the next eight months.

This would put us at levels above Canada and NZ which have ALREADY experienced property price falls as high as 18.5%.

The property market is mainly reactive (meaning people’s borrowing power doesn't get impacted until the cash rate ACTUALLY increases).

We expect to see prices fall in order of magnitude larger than the falls we are seeing happen across New Zealand and Canada.

We have an internal model which predicts a ~3% fall in property prices for every 0.25% increase in the cash rate.

So far, the cash rate is up by 1.25%, and although Corelogic data is still showing ~4% falls from the peak, we have started to see some properties show price falls of ~5-10% in some parts of Melbourne and Sydney...

Our view is that the real test for property markets will come when the cash rate goes above levels we have not seen since <2016, potentially only three rate hikes away now.

Watch this space.

Great work, keep it up mate !

Nice work. I feel you're preaching to the choir here though. Everyone who knows what's coming has know it for a long time and everyone else doesn't want to hear it.