Interest rate cuts and a tsunami of property listings

What’s on our mind: Will rate cuts bring with them higher property prices? Or will the sellers overwhelm any incremental increase in buyer demand?

What happened this week: Media speculation on an RBA rate cut keeps ramping up…

What are we watching next week: RBA cash rate decision on February 18th at 2:30 pm (AEDT)

Prelude:

What’s on our mind:

Will rate cuts trigger a boom in housing prices?

The market consensus right now is that YES, it will.

Our view is that they won't…

As always, the two most important factors influencing prices are 1) Supply and 2) Demand.

Interest rates impact demand.

The higher rates go, the lower the appetite from buyers to take out mega mortgages…

Higher servicing costs make it harder to get loans so there is less demand from buyers in the market.

Rate cuts will mean some buyers who were previously priced out, return to the market.

But we think the impact of rate cuts will be felt mostly on the demand side.

The reason why is Supply…

Nobody wants to sell their home into a rough market…

In 2022 rates started rising, and most property owners/investors thought they wouldn’t go anywhere near as high as they have come today.

In 2023, most had started to call for rate cuts already…

In 2024 the capitulation started to set in, as months went by with no rate cut in sight.

For almost 2 years homeowners put off selling their properties, even in situations where mortgage payments were starting to strain household budgets.

Instead, homeowners decided to try and hold on and relist their properties when the market was strong again (after rate cuts started).

You can see this playing out in the collapse in household savings ratios across Australia over the last 12-24 months AND personal lending data:

You can also see it playing out in property listing data.

Total listings volumes were close to the 2015 lows…

The lack of supply is what kept prices high and rising in some of the more sought-after pockets of the market.

(anyone who tracks prices in the suburbs will know rising prices were not across the board…)

We said this would happen in a previous article:

But things are changing pretty quickly.

Households can only bear high interest rates for so long…

AND listings are back on the rise.

We have seen (and heard from agents) that there is a tsunami of listings coming to market early in 2025.

Our view is that rate cuts, seller enthusiasm and a backlog of listings that have been waiting for the RBA to cut will mean supply explodes way above where demand in the market is.

We are already seeing it in the data - and our house view is that the incremental demand increase from a tiny rate cut will be far outweighed by the avalanche of supply that is hitting the market.

What happened the last time a country cut rates after years of rising rates?

Well the US did in 2007, just before the housing bubble collapsed and caused a global recession…

Rates got cut in the US and US housing prices collapsed…

Let's go back to ~2004 when the property market had just started heating up.

In the early 2000s following the tech crash, the US Fed cut interest rates to ~1%.

Over the next 6-7 years, property prices started rising significantly.

Responding to a heating up housing sector and inflation rates in mid-2004, the US Fed started increasing rates.

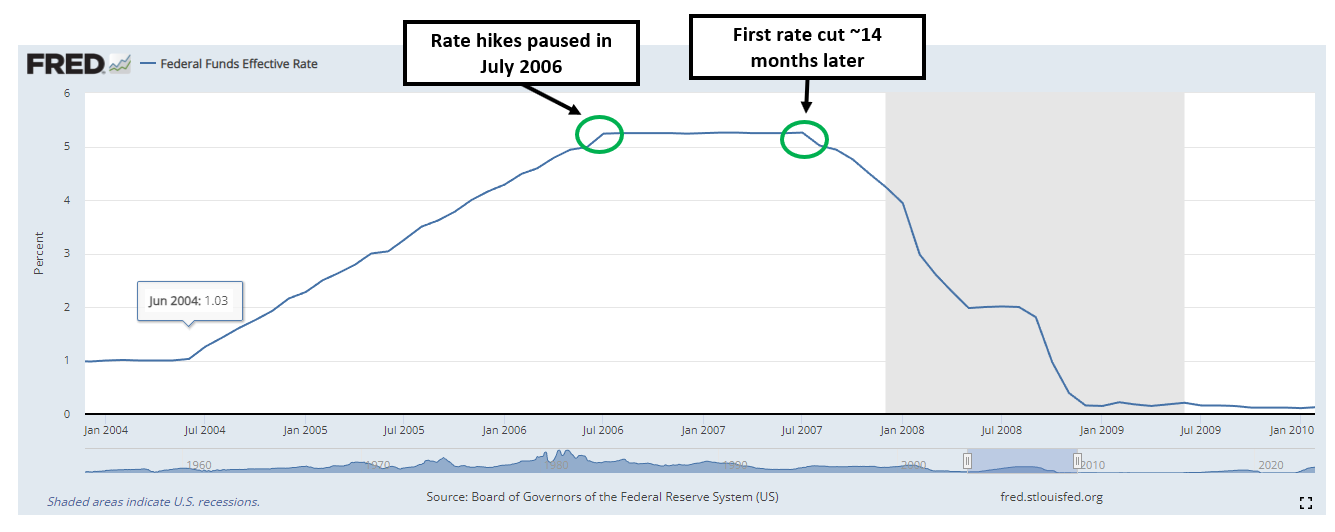

Rates kept going up until mid-2006 and peaked at ~5.25%.

Rates eventually stopped rising in July 2006.

Rates had stopped rising, but cracks started appearing in the US economy.

In December 2006 ‘Ownit Mortgage Solutions’ filed for bankruptcy.

April 3rd 2007 - ‘New Century Financial’, a large subprime mortgage lender, filed for bankruptcy.

By July 2007, two troubled Bear Stearns hedge funds with exposure to property debt filed for bankruptcy.

In August, the problem started spreading to the rest of the world, and German bank IKB Deutsche had to be bailed out by a German state-run bank due to troubles from exposure to U.S. Subprime loans.

On August 6th 2007 ‘American Home Mortgage Investment Corp’ filed for bankruptcy.

Eventually, ~1.5 years after the pause in rate hikes, the market implosion was getting out of control, and the US Fed started cutting rates.

On the 16th of August 2007, the Fed cut rates for the first time in ~14 months.

But what followed wasn't a period of calm OR a roaring recovery in property prices.

In fact, the situation got a whole lot worse.

By March 2008, banks in the US and worldwide had suffered billions of dollars in write-downs, and Bear Sterns was sold off to JP Morgan for US$2 per share.

The bank's share price was ~US$165 per share only a year ago.

Things got even worse in September 2008 when Lehman Brothers, one of the USA’s biggest banks (at the time), went bust.

We could go on about the Global Financial Crisis for days, but the key takeaways for us are:

The US Fed pause in rate hikes signalled the top of the market.

For the 12 months after the pause, cracks in the economy started appearing.

Only ~14 months later, the FED began to cut rates as companies exposed to the property sector filed for bankruptcy.

The US Fed rate cuts coincided with the collapse in the property sector.

So while market commentators want us to believe that rate pauses and hikes are GOOD for the market - history tells us it is nothing but bad news…

For those interested, the following publication gives an excellent month-by-month summary of the lead-up to the GFC in 2008.

(Source)

Thanks for reading,

Aus_Prop team.

You can contact us here:

On Twitter @Aus__Property

Via email at Auspropertymarket@gmail.com

Or through Substack - Property Down Under